The Pricing Puzzle Every New Host Faces

It’s been more than a decade since starting my Airbnb journey and I felt like I stepped into quicksand. I’d spend hours researching comparable properties, only to second-guess my rates when bookings slowed. Sound familiar?

Here’s what I learned: Airbnb pricing isn’t just about matching competitors. It’s about creating a system that adapts to market changes while you sleep.

When I first listed my property, I made the classic mistake of setting one flat rate year-round. My calendar stayed full during the off-season (great!), but I missed thousands in potential earnings during peak periods (not so great).

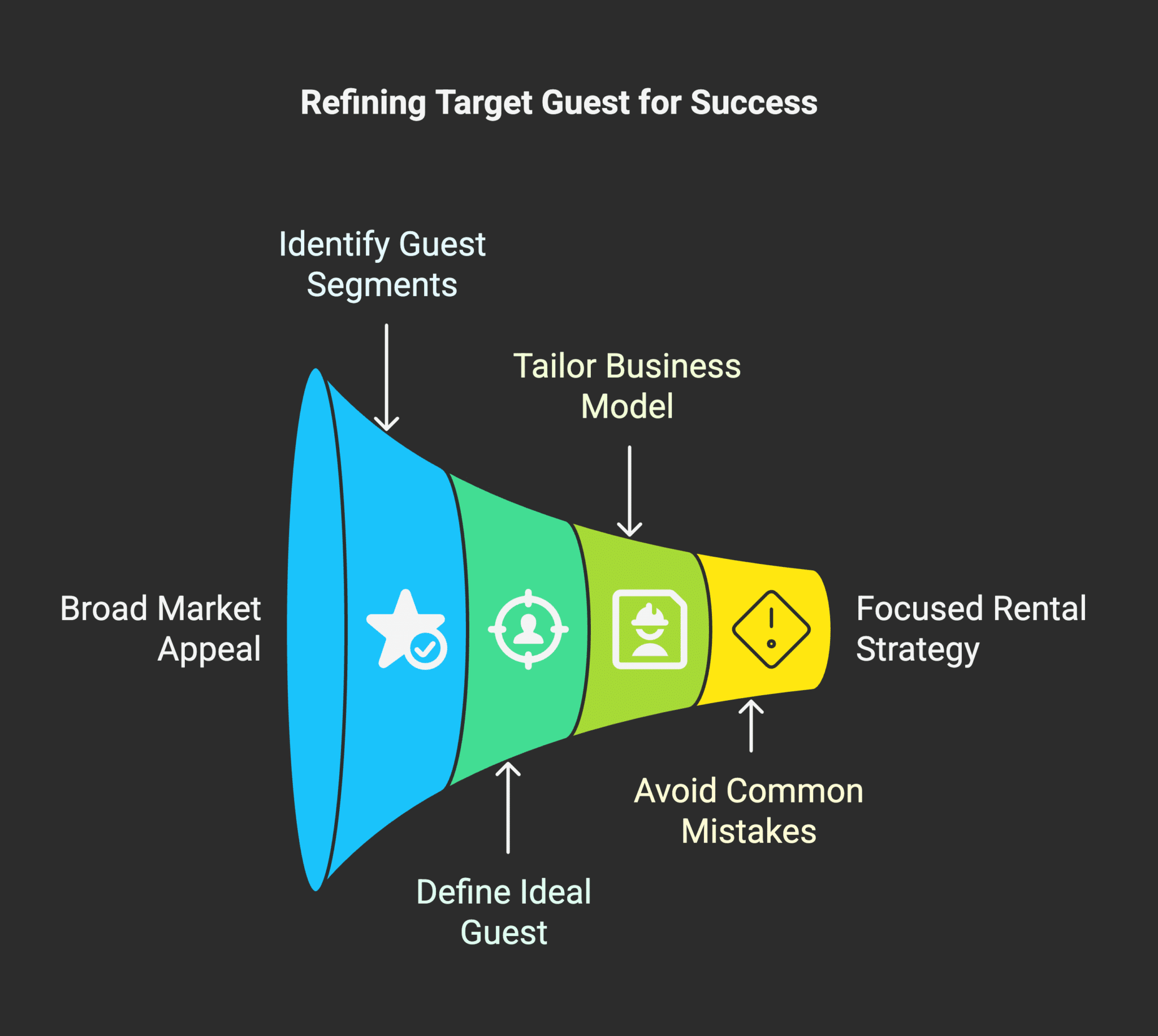

The truth? Most new hosts face this exact struggle. They waste time trying to balance “competitive” rates with actual profit, all while missing the fundamental point: pricing is the hardest part of this business because it’s about delivering clear value to specific target customers. Without knowing exactly who you’re serving, the Airbnb algorithm isn’t the only thing judging your pricing decisions—the market is, too.

Let me share something that changed everything for me: when you’re crystal clear about who your ideal guests are, pricing becomes a strategic advantage rather than a guessing game. Your rates directly impact not just your income, but your listing’s visibility to the right people. Airbnb rewards listings that offer genuine value to specific customer segments—which is why understanding exactly who you serve drives everything else.

I wasted six months making pricing adjustments based on gut feelings rather than data. Don’t repeat my mistakes. The strategies I’m about to share helped me increase my monthly revenue by 32% without working additional hours.

The best part? These methods work whether you have one apartment or ten cabins. They apply in big cities and small towns. And they don’t require an MBA to implement.

This isn’t about complex spreadsheets or paying for expensive software (though we’ll cover tools that make life easier). It’s about building a pricing foundation that grows your business while giving you back your time.

Ready to transform your pricing from guesswork to strategy? These seven approaches helped me break through the $4,000/month barrier. They can work for you too.

STR Break-Even Calculator

Calculate your minimum nightly rate to ensure profitability for your short-term rental

Strategy 1: Know Your Minimum Viable Rate (Then Focus on Value)

Before making any pricing decisions, you need clarity on your absolute baseline—not to charge this rate, but to know where your hard floor stands.

When I first started hosting, I made the mistake of focusing solely on what others charged. But smart pricing starts with understanding your own numbers. Your pricing strategy must begin with financial clarity and then quickly move to value-based positioning.

Start by calculating your break-even point—the absolute minimum you need to charge to cover all expenses. This includes mortgage/rent, utilities, cleaning fees, supplies, Airbnb service fees, taxes, and a maintenance reserve.

For a two-bedroom condo, this breakdown was eye-opening:

- Monthly mortgage and HOA fees: $1,800

- Average utilities: $240

- Cleaning costs (assuming 10 turnovers/month): $650

- Supplies/replacements: $120

- Airbnb fees (average): $290

- Taxes and insurance: $350

- Maintenance reserve: $100

Total monthly expenses: $3,550

Dividing by 30 days, I needed to average $118 per night just to break even. But this calculation revealed something critical: during weekdays in my market, many comparable listings charged only $99-109.

The solution wasn’t lowering my price to match competitors (which would guarantee a loss). Instead, I needed to focus on what specific value I could offer to guests willing to pay rates that would actually be profitable.

This baseline analysis showed why occupancy alone is a misleading metric. A fully booked calendar at below-break-even rates equals guaranteed losses, regardless of your glowing reviews. Some of the most profitable properties I know run at 60-70% occupancy but charge rates that their ideal guests gladly pay for specific value.

Remember: what you need is a high-profit business, not a high-occupancy business. Many hosts obsess over filling every night when they should be focusing on maximizing profit per booking. An 80% occupied property with strategic pricing and add-on services can be significantly more profitable than a 95% occupied property competing solely on price.

Your action step: Calculate your true break-even rate as your hard minimum, then shift your focus to identifying what specific value you can offer that justifies charging rates well above this floor. This single mindset shift prevents the most common pricing mistake new hosts make—competing on price rather than value.

Strategy 2: Master Seasonal Pricing Adjustments

The biggest pricing mistake I see new hosts make is setting the same rate year-round. This approach guarantees you’ll either leave money on the table during high season or sit vacant during low season.

In one of my markets (suburban Texas), summer weekends can command 40% higher rates than winter weekdays. But I discovered this pattern too late, after locking in several peak-season bookings at off-season rates.

Creating a seasonal pricing calendar isn’t complex, but it requires local market knowledge. My approach focuses on identifying your market’s specific patterns:

First, map out your local demand drivers to effectively price your Airbnb. In my area, these include:

- Summer vacation season (June-August)

- Holiday periods (Thanksgiving, Christmas, New Year’s)

- Major sporting events

- University calendar events (graduation, move-in weekend)

- Local festivals and conventions

Next, collect historical data. I pulled two years of occupancy rates from AirDNA for my neighborhood, revealing clear patterns of demand fluctuation.

From this analysis, I created five distinct seasonal pricing tiers:

- Peak season (30-40% above baseline)

- High season (15-25% above baseline)

- Shoulder season (baseline rates)

- Low season (10-15% below baseline)

- Off-season (20-30% below baseline)

This tiered approach increased my annual revenue by over $6,000 compared to flat-rate pricing, even with the same overall occupancy.

The real power comes from adjusting these seasonal rates based on the day of the week. In my market, Friday and Saturday command a 25-35% premium over weekdays. By implementing both seasonal and day-of-week adjustments, I effectively stopped subsidizing weekday guests with lost weekend revenue.

Your action step: Create a simple calendar mapping your market’s high and low seasons, then set clear price tiers for each. This foundation will support all your other pricing strategies.

Strategy 3: Understand the Ripple Effects of External Events

One of the most eye-opening realizations in my STR journey was how seemingly unrelated events can dramatically impact demand and pricing in unexpected ways.

Pricing in this business is ever-changing because the world is interconnected in ways most hosts never consider. Let me share a counterintuitive example that taught me this lesson:

A hurricane in Texas affected my bookings in California.

You might wonder what Texas weather has to do with California occupancy.

The answer? American Airlines—and therefore everything.

American has major hubs in Texas that connect thousands of travelers to California daily. When those hubs get disrupted, people get stuck, new arrivals can’t come in, and suddenly, your California property faces unexpected vacancies even though it’s sunny and perfect outside your door.

This kind of butterfly effect happens constantly in the STR world, and most hosts completely miss it. When I started monitoring these broader connections, I developed a new approach to pricing that includes:

- Transportation disruption tracking: I now follow major airlines, train systems, and even interstate closures that affect my properties. A simple Google Alert for “[Airline Name] + disruption” gives me advance notice of potential booking impacts.

- Event cascade monitoring: I create radius-based event calendars that go far beyond my immediate location. My Southern California property is affected by events up to 100 miles away because travelers will expand their search radius for major attractions.

- Flexible emergency pricing protocols: I’ve developed specific pricing adjustment protocols for different types of external events—both negative (natural disasters, transportation disruptions) and positive (surprise concert announcements, viral local attractions).

The most profitable insight? Events create bidirectional pricing opportunities. When something negative happens, you need to adjust downward for immediate vacancies, but you can often charge premiums for medium-term stays as displaced people need temporary housing.

For example, when wildfires affected areas near (but not at) my property, I temporarily lowered weekend rates to fill immediate vacancies but increased weekly rates and marketed specifically to displaced families and emergency workers who needed reliable medium-term accommodations.

On the positive side, surprise events create instant demand surges. When Beyoncé, Taylor Swift, or Nicki Minaj announce a concert, their fans will pay premium rates to see their favorite artist, which can create a surge in demand for local Airbnb listings. I’ve seen rates double overnight when major performers announce shows.

This extends to all kinds of special events—sporting events like the Long Beach Grand Prix, political conventions, the Super Bowl, and even niche events like rodeos or car races. Did you know that properties near racetracks with space to park a special car or rural properties with space for horses during rodeo season can command enormous premiums?

The 2028 Los Angeles Olympics is already influencing long-term STR investment strategies in Southern California, with some investors securing properties specifically for that future opportunity.

Remember: where there’s chaos, there’s cash flow. Emergency situations like hurricanes, mudslides, and fires create urgent need for short-term accommodations. The COVID pandemic completely transformed pricing, use cases, and cleaning protocols—driving up costs but also forcing wider adoption of STRs over traditional hotels.

Your action step: Create three monitoring systems:

- Transportation disruption alerts for major carriers serving your area,

- A 100-mile radius event calendar that includes both planned and potential surprise events and

- A pricing response protocol for different types of external factors, both positive and negative.

Strategy 4: Implement Strategic Discounts That Actually Make Sense

Not all discounts are created equal. Some erode your profits while others dramatically increase them. The trick is knowing which is which.

I used to offer a standard 20% weekly discount and a 30% monthly discount because that’s what everyone else did. This was a costly mistake.

After analyzing my booking patterns and expenses, I discovered that longer stays had dramatically lower costs per night due to:

- Reduced turnover cleaning expenses

- Lower messaging and management time

- Decreased wear and tear

- Eliminated vacancy risk between bookings

However, the optimal discount varies significantly by season. During peak periods with near-guaranteed occupancy, offering steep, long-stay discounts made no financial sense. Conversely, during the off-season, when daily bookings were sparse, I could offer more substantial discounts while still increasing profits.

I redesigned my discount structure around these insights:

Peak Season:

- Weekly discount: 8-10%

- Monthly discount: 15-18%

Shoulder Season:

- Weekly discount: 15-18%

- Monthly discount: 22-25%

Off Season:

- Weekly discount: 20-25%

- Monthly discount: 30-35%

This seasonal discount approach increased my annual revenue by approximately $3,800 while actually booking more long-term stays. The key was offering more aggressive discounts when vacancy risk was high and more conservative ones when demand was strong.

I also implemented last-minute discounts for unbooked dates within 3-7 days but with an important twist: these discounts never went below my break-even rate. Some revenue is better than none, but booking below cost makes no business sense.

Your action step: Analyze your true cost savings for longer stays, then create a seasonal discount structure that reflects both these savings and your occupancy patterns.

Strategy 5: Leverage Special Event Pricing Like a Pro

Special events represent your biggest opportunities for premium pricing—if you know how to capitalize on them.

In my market, certain weekends command rates are 2-3 times higher than normal. These include major sporting events, festivals, conventions, and university-related dates like graduation.

My initial approach to event pricing was reactive—I’d notice increased search activity and adjust prices based on gut feeling. This approach missed opportunities and often didn’t capitalize fully on peak demand.

Now, I use a systematic approach to event pricing for my Airbnb properties:

- Create an annual calendar of known events (sporting calendars, convention schedules, university dates)

- Research historical pricing impacts of each event using tools like AirDNA or simply checking Airbnb during this year’s event

- Set rates at 85-90% of what premium hotels charge during these periods

- Block these special event dates 9-12 months in advance with higher minimum stay requirements

- Gradually release them if they don’t book at premium rates

This proactive approach helps me identify opportunities others miss. For example, I discovered that a medical conference brings 5,000 visitors annually to my area, yet few hosts adjust prices accordingly. By targeting these dates specifically, I secure bookings at 75-100% above my baseline rates.

The biggest mistake hosts make with event pricing is waiting too long. Major events create booking demand 6-12 months in advance. By mapping out your event calendar proactively, you can set premium rates before most of your competition and make more money.

I recommend creating three tiers of event pricing:

- Tier 1 (Major): 75-100%+ above baseline

- Tier 2 (Medium): 40-75% above baseline

- Tier 3 (Minor): 20-40% above baseline

Your action step: Research and calendar all local events impacting your short-term rental market for the next 12 months. Set preliminary rates now, even if you adjust them later as the dates approach.

Special Event Pricing: Visualized

See how strategic event pricing affects your rates throughout the year

Strategy 6: Connect Pricing to Value Signaling (Not Just Competition)

Understanding your competition matters, but true pricing power comes from signaling specific value to your target customers.

I discovered this when I realized my vacation rental primarily attracted families with small children. Instead of simply matching competitor rates, I made three strategic changes to my pricing model that transformed my business:

First, I invested in family-specific amenities—pack and play, high chair, and stroller—and prominently featured these in my first five listing photos. This wasn’t just about amenities; it was about signaling specific value to my target guests before they even considered the price.

Second, I positioned my rates strategically against different types of competitors. Rather than trying to be cheaper than everyone, I priced:

- 10-15% higher than standard 2-bedroom units without child amenities

- 5-10% lower than properties marketed as “luxury family” accommodations

- Significantly higher on weekends to filter out local party crowds

This approach attracted precisely the guests I wanted—families willing to pay for convenience and safety, not bargain hunters looking for the absolute cheapest option.

Third, I added specific value callouts in my listing title and description that justified my premium: “Family-Ready Condo: Pack-n-Play, High Chair & Stroller Included.” This transparency about included value gave families permission to choose my higher-priced listing because they understood the specific benefits.

The results were remarkable. My occupancy remained above 90%, while my average nightly rate increased by 18%. Even more importantly, I attracted guests who treated my property with respect and often returned for multiple stays.

This taught me that people rarely buy on price alone. The guests who shop purely on price are typically not the ones you want. By using price as a deliberate filter and connecting it to clearly communicated value for specific target guests, you attract better bookings while increasing revenue.

Your action step: Identify three specific value points that matter to your ideal guests, make them visually obvious in your listing photos, and adjust your pricing to reflect this added value rather than simply matching competitor rates.

Strategy 7: Build a High-Profit Business, Not a High-Occupancy Business

The biggest mindset shift that transformed my hosting business was this: occupancy is vanity, and profit is sanity.

When hosts ask me how to increase their occupancy rate, I ask them a better question: “How can you increase your profit per guest?” Most of the time, occupancy isn’t the real problem. Getting someone to stay at your property is just the beginning of the revenue opportunity—like the hamburger at McDonald’s.

McDonald’s doesn’t make their real money on the burger itself. They make money by satisfying the customer’s entire need. When people go to McDonald’s, they don’t order just a burger—they order the #1 meal. It’s packaged together conveniently, and McDonald’s makes their significant profit on high-margin items like soft drinks, not the food.

The biggest challenge most Airbnb hosts face is trying to make 100% of their revenue from the nightly rate when the key is understanding loss leaders and additional revenue streams in their pricing model. This completely transforms your pricing strategy.

Here’s how I applied this thinking to my STR business:

First, I studied major hotels and Vegas casinos. They often offer discounted rooms because they know the real profit comes from restaurants, shows, and other services. I created my own version by developing three value-added packages guests could add to their stay:

- Work-Ready Package: Upgraded internet, second monitor, and ergonomic chair ($35/stay)

- Family Welcome Package: Additional toys, child-proofing equipment, and local activity passes ($45/stay)

- Extended Stay Package: Mid-stay cleaning, premium supplies, and local experience discount card ($75/week)

These packages have 70-80% profit margins and are chosen by about 40% of my guests, adding an average of $22 per booking to my bottom line.

Next, I created a tiered internet approach:

- Basic internet: Included free

- Streaming quality: $5/day

- Business-class dedicated connection: $15/day or $75/week

This simple addition generates about $150-200 extra revenue per month with virtually no additional cost, as I already had the business-class connection for the entire property.

The most powerful change was creating a customer retention system. I realized that acquiring a new guest costs 5-7 times more than keeping an existing one. By offering returning guests a 10% discount (but no cleaning fee), I:

- Increased repeat bookings from 8% to 27% of all stays

- Reduced vacancy periods between bookings

- Virtually eliminated problem guests (they self-select out)

This approach means I can sometimes afford to use my base rate as a strategic loss leader—offering competitive or even below-market nightly rates during specific periods because I know my actual profit comes from the complete customer revenue picture, not just the nightly rate.

Understanding your customer acquisition cost is essential. For me, it costs about $85 in marketing, time, and platform fees to acquire each new booking. When a guest returns, I avoid that cost entirely. This knowledge allows me to make strategic pricing decisions that might appear counterintuitive but lead to higher overall profit.

Your action step: Identify at least three value-added revenue opportunities beyond your nightly rate, create tiered pricing for at least one amenity or service, and develop a simple system to encourage repeat bookings. Then adjust your base pricing strategy with this complete revenue picture in mind.

Strategy 8: Turn Cleaning Into a Profit Center

Most hosts view cleaning as a necessary expense to pass along to guests. This limited thinking misses a significant profit opportunity that’s hiding in plain sight.

During my first year of hosting, I simply charged guests exactly what my cleaners charged me—treating it as a pass-through cost. This was a major oversight that I’ve since corrected, transforming cleaning from a zero-sum transaction into a legitimate profit center.

Here’s how I’ve approached this:

First, I recognized that cleaning isn’t just about exchanging money for service—it’s about value delivery. A professionally cleaned space is one of the most tangible aspects of quality that guests experience. When I elevated my cleaning standards beyond the basics (adding aromatherapy diffusers, premium supplies, and welcome touches), I created a justification for premium pricing.

I now structure my cleaning fees in tiers:

- Basic Turnover: Passes along my actual cleaner costs (currently $95 for my 2BR)

- Enhanced Cleaning: Adds $30 for premium supplies and extra attention ($125 total)

- Deep Clean: Full service with specialized treatments for allergy sufferers ($165)

About 35% of my short-term rental guests opt for enhanced or deep cleaning, and my profit margin on these upgrades is approximately 70%. This adds an average of $15-20 per booking to my bottom line.

Second, I negotiated bulk rates with my cleaning team by guaranteeing them a certain volume of work. By bringing them multiple properties (some belonging to other hosts in my network), I secured a 15% discount on their standard rates. I pass along the standard rate to guests, creating another profit margin.

Third, I created a mid-stay cleaning program for stays longer than 5 days. These are high-margin services because they’re lighter touch than full turnovers and can be scheduled during business hours when my cleaning team has more availability.

Most importantly, I’ve documented my cleaning protocols as a valued part of my guest experience, not just a required task. In my listing description and pre-arrival communications, I highlight our “signature cleaning process” as a premium feature, which further justifies both the cleaning fee and the nightly rate.

The hospitality industry has always known that cleaning represents a pricing opportunity, not just a cost. Hotels build significant margins into their operational fees. By adopting this mindset, you can transform a necessary expense into a legitimate profit center without changing your actual workload.

Your action step: Create at least two tiers of cleaning services, negotiate volume discounts with your cleaning providers, and position your cleaning standards as a premium feature in your marketing materials. Track the additional profit this generates, separate from your nightly rate revenue.

Next Steps: Embracing the Chaos for Maximum Cash Flow

These eight strategies (I know I said 7, but you’re not complaining now, are you?) work best when implemented as a complete system, and here’s the truth: pricing in this business is ever-changing—you’re essentially predicting the future all the time.

We’re up against the hospitality industry, airlines, and hotels that have entire departments and millions of dollars dedicated to predicting what the price should be for a room on a random Tuesday two days after it rains, four months from now. It’s challenging, but as I’ve learned, where there’s chaos, there’s cash flow.

My current approach combines all these elements:

- Clear identification of my top 3 target guest segments

- Strategic value signaling through photos and amenities

- Using price as a deliberate filter for the guests I want (and don’t want)

- Creating multiple revenue streams beyond just the nightly rate

- Monitoring external events and their ripple effects on demand

- Converting necessary expenses like cleaning into profit centers

- Focusing on profit per booking rather than just occupancy

- Developing response protocols for both emergencies and opportunities

The result is a system that maximizes profit while attracting the right guests who appreciate the specific value I provide—and keeps them coming back.

For new Airbnb hosts, start by getting crystal clear about who your ideal guests are and what additional value you can offer them beyond just a place to sleep in your short-term rental properties. Without this foundation, all other pricing strategies will underperform. Then, gradually incorporate the other strategies as you refine your understanding of your total revenue opportunity.

Remember that the dynamic nature of this business—from natural disasters to surprise concert announcements—is exactly what creates opportunity. Study industries like airlines, Vegas hotels, and major retailers to understand how they use dynamic pricing, loss leaders, and value-adds to maximize customer value.

The strategies I’ve shared helped me transition from an uncertain beginner to a confident host with a complete revenue system that’s adaptable to changing conditions. They’ve allowed me to increase my average profit per booking by over 40% while maintaining strong occupancy, ultimately boosting my monthly revenue from $3,200 to over $4,200.

These same approaches can work for you, regardless of your property type or location. Just because it’s challenging doesn’t mean you should quit. In fact, the challenges create the opportunities that most hosts miss. By embracing the ever-changing nature of this business and building systems to capitalize on it, you can build a truly profitable STR business that thrives in any market condition.

Ready to transform your approach from simply “setting a price” to building a complete revenue system? Start by identifying your top 3 target guests today, then build your complete revenue system around their specific needs and values—not just around occupancy.

Your first profitable booking is closer than you think.

Jermaine Massey

Frequently Asked Questions About Airbnb Pricing

Get answers to common questions about setting effective rates for your short-term rental

Airbnb pricing allows hosts to set their own rates for their properties. Hosts have two main options:

- Use Airbnb’s Smart Pricing feature (if you have nothing else), which automatically adjusts rates based on:

- Seasonality

- Local events

- Market demand

- Manually set prices or use third-party software like PriceLabs or Beyond Pricing to optimize rates and maximize revenue.

Some proven Airbnb pricing strategies include:

- Implement dynamic pricing to adjust rates based on market trends and demand.

- Offer discounts for extended stays.

- Set different prices for weekdays and weekends.

- Adjust rates for special occasions and events.

- Conduct a competitive pricing analysis to align with similar properties.

- Provide additional services or amenities to justify higher prices.

- Regularly review and update your pricing strategy to maximize occupancy and revenue.

- Also reading this entire article would go a long way to help you too.

To set the right pricing for your Airbnb listing, consider the following:

- Research your local market and competition.

- Factor in seasonality and local events.

- Analyze your property’s unique features and amenities.

- Consider your target audience (e.g., business travelers or families).

- Use dynamic pricing tools to stay competitive.

- Regularly review your occupancy rates and adjust prices accordingly.

It’s also important to factor in your costs and desired profit margin when setting your base price.

Airbnb photos are crucial in your pricing strategy. High-quality, attractive photos can justify higher prices by showcasing your property’s best features. Professional photos increase perceived value, allowing you to set a higher price point. Additionally, great photos improve your listing’s visibility in search results. This can lead to more bookings and help you maintain competitive pricing.

Dynamic pricing software, like PriceLabs or Beyond Pricing, helps Airbnb hosts by:

- Automatically adjusting rates based on real-time market data.

- Responding to demand fluctuations and local events.

- Analyzing various factors to suggest optimal pricing.

These tools save time on manual price adjustments and provide insights into market trends. This allows hosts to make data-driven decisions and stay competitive.

Best practices for setting your Airbnb pricing include:

- Regularly review and adjust your rates.

- Offer competitive prices for your market and property type.

- Consider seasonal fluctuations and local events.

- Provide discounts for extended stays or last-minute bookings.

- Set minimum stay requirements during peak periods.

- Use a dynamic pricing strategy.

It’s also important to maintain pricing consistency across different platforms, especially if you list on multiple sites like Booking.com in addition to Airbnb.

To balance competitive pricing with profitability, Airbnb hosts should:

- Carefully calculate their costs (including mortgage, utilities, cleaning, and maintenance).

- Set a base price that ensures a reasonable profit margin.

- Use dynamic pricing to capitalize on high-demand periods.

- Offer competitive rates during low seasons to maintain occupancy.

- Provide value-added services or amenities to justify higher prices.

- Regularly analyze their average daily rate and occupancy to maximize revenue.

Staying informed about local market trends is also crucial for adjusting your strategy accordingly.

Source Transparency:

1. **Dynamic Pricing Tools:** Hostfully’s analysis highlights Airbnb Smart Pricing’s tendency to undervalue properties.