The short-term rental market is set to explode to $335.83 billion by 2032. After helping hundreds of entrepreneurs transform rental arbitrage from a side hustle into a thriving business, I’ve discovered the secret to success: the perfect blend of mindset, skillset, and toolset.

Your mindset shapes everything. It’s different between seeing that midnight maintenance call as a disaster or an opportunity to wow your guests.

Your skillset powers your execution. From market analysis to guest relations, these capabilities turn plans into profits.

Your toolset amplifies your impact. Whether it’s your property management software or your reliable cleaning crew, these resources consistently help you deliver five-star experiences.

I’m excited to share my complete blueprint for rental arbitrage success. In this guide, you’ll discover:

- How to develop the entrepreneurial mindset that drives success

- Essential skills that separate thriving businesses from struggling ones

- Must-have tools and resources that streamline your operations

Whether you dream of building an Airbnb empire or focusing on corporate rentals, you’ll learn exactly what it takes to succeed in today’s dynamic short-term rental market.

Ready to turn your rental arbitrage dreams into reality? Let’s dive into the fundamentals that will set you apart from the competition.

Understanding Rental Arbitrage Fundamentals

Want to start an Airbnb business without buying a property? Now, you’re finally doing things the “right way.” Rental arbitrage could be your ticket to the booming short-term rental market.

Let me break down this exciting business model for you. Imagine paying $2,000 monthly for an apartment, then earning $4,000 by renting it out on Airbnb – that’s rental arbitrage in action! It’s revolutionizing how rental arbitrage hosts enter the real estate market.

Lease Property

Secure long-term rental agreement (12+ Months)

List on Platforms

Create listings on Airbnb/VRBO

Make Profits

Earn more than your lease payment.

Example: $2,000 monthly lease → $4,000+ monthly revenue

Here’s what makes rental arbitrage so attractive:

- Low Initial Investment: Unlike traditional real estate investing, rental arbitrage allows you to enter the market without needing hundreds of thousands in property purchase costs.

- Flexible Growth: Start with one unit and expand as you gain experience and capital.

- Market Testing: Easily switch locations if your current area underperforms.

The key to success? Math. Math and money are the same. Do the math and the math will tell you what to do.

Your short-term rental income needs to significantly exceed your long-term rental costs.

For example, a $2,000 monthly lease could generate $4,000-$6,000 in short-term rental revenue through an Airbnb rental arbitrage strategy, creating a healthy profit margin after expenses.

Important Considerations:

- Research local regulations thoroughly

- Get written permission from property owners

- Understand seasonal market fluctuations

- Plan for vacancy periods

Remember: While rental arbitrage offers exciting opportunities, it’s not a get-rich-quick scheme. Success requires careful planning, market research, and dedicated property management.

Want to explore this opportunity? Your first step is understanding your local market and regulations. Let’s dive deeper into how to make this business model work for you.

Market Analysis and Location Strategy

Ready to find your perfect rental arbitrage location? Success in this business isn’t just about picking a random property – it’s about picking the right property in the right place. Did you know that location can impact your occupancy rates by up to 40%? Let’s dive into how to choose your winning spot.

Location Success Factors

| Factor | What to Look For | Impact on Success |

|---|---|---|

| Tourist Traffic | Annual visitor numbers, peak seasons | High correlation with occupancy rates |

| Business Activity | Corporate offices, convention centers | Steady weekday bookings |

| Local Regulations | Short-term rental laws, permits | Determines feasibility |

| Competition Analysis | Number of listings, pricing | Affects revenue potential |

| Amenities Access | Restaurants, attractions, transport | Influences booking rates |

Your profitable rental arbitrage journey starts with these key location considerations:

- High-Demand Areas: Focus on locations that attract:

- Weekend tourists seeking experiences often prefer short-term rental properties for their stays.

- Business travelers needing weekday accommodations

- Event attendees during peak seasons

- Local Market Indicators:

- Average daily rates in your target area

- Seasonal occupancy patterns

- Existing short-term rental supply

- Infrastructure and Amenities:

- Transportation hubs within 15-30 minutes

- Popular attractions nearby

- Essential services (groceries, restaurants)

Pro Tip: Don’t just look at today’s market – research upcoming developments, new attractions, or business expansions that could boost future demand in your chosen area.

Before making your final decision, create a location scorecard. Rate each potential area on:

- Legal compliance feasibility

- Revenue potential vs. competition

- Year-round demand stability

- Growth prospects

Remember: The perfect location balances strong demand with reasonable operating costs. Take time to research thoroughly – it’s better to spend an extra week analyzing than to spend a year stuck in an underperforming market!

Need help evaluating specific locations? Let’s explore the next section about financial planning to understand how location choices impact your bottom line.

Financial Planning and Projections

Think of financial planning as your rental arbitrage GPS – without it, you might be heading in the wrong direction! Let’s crunch some real numbers that can make or break your business.

According to industry data, successful rental arbitrage properties typically aim for a minimum 30% profit margin after all expenses.

Monthly Profit Calculator Example

Income

Expenses

Let’s break down the essential financial components:

- Startup Costs:

- Security deposits ($2,000-4,000)

- Furniture and decor ($5,000-15,000)

- Professional photos ($200-500)

- Initial supplies ($500-1,000)

- Monthly Fixed Expenses:

- Long-term lease payments

- Utilities and internet

- Insurance coverage

- Property management software

- Variable Costs:

- Cleaning services

- Supplies replenishment

- Maintenance and repairs

- Platform commissions (3-15%)

Pro Tip: Always maintain a cash reserve equal to 3 months of expenses. This buffer helps you weather seasonal downturns or unexpected costs in the short-term rental arbitrage market.

Creating accurate financial projections for your Airbnb listing requires understanding the local rental market.

- Analyzing local market rates

- Understanding seasonal patterns

- Calculating realistic occupancy rates

- Estimating all potential expenses

Remember: Success in rental arbitrage isn’t just about maximum revenue but sustainable profit margins. Start conservatively with your estimates and adjust based on actual performance data.

Ready to move beyond the numbers? Let’s explore how effective operations management strategies can make these projections real.

Operations and Management Structure

Running a rental arbitrage business is like conducting an orchestra – every element needs to work in perfect harmony! From guest check-ins to maintenance calls, your operational system determines whether you create a five-star experience or a one-star headache.

Daily Operations Workflow

Guest Communication

0800-0900

- Check messages

- Send check-in instructions

- Review upcoming bookings

Property Management

0900-1100

- Coordinate cleaners

- Schedule maintenance

- Quality checks

Business Development

1100-1400

- Review analytics

- Adjust pricing

- Marketing tasks

Maintenance & Supply

1400-1600

- Property inspections

- Restock supplies

- Address repairs

Evening Review

1600-1700

- Confirm check-ins

- Next-day preparation

- Emergency contacts

Let’s break down the key operational components:

- Management Systems:

- Property management software

- Automated messaging systems

- Digital guidebooks

- Smart lock management

- Team Structure:

- Property manager (you or hired)

- Cleaning service

- Maintenance personnel

- Virtual assistants

- Standard Operating Procedures:

- Detailed cleaning checklists

- Guest screening protocols

- Emergency response plans

- Preventive maintenance schedules

Pro Tip: Create digital SOPs (Standard Operating Procedures) for every recurring task. This makes training easier and ensures consistency across properties.

Key Operational Focuses:

- Guest satisfaction monitoring

- Quality control systems

- Performance tracking

- Team communication

Remember: The best operations are the ones you don’t hear about – they work smoothly in the background. Invest time in creating systems that can run without your constant attention.

Want to maximize your property’s potential? Let’s explore marketing strategies that will keep your calendar full year-round.

Marketing and Distribution Strategy

Want to stand out in the crowded short-term rental market? Great marketing isn’t just about pretty pictures – it’s about reaching the right guests at the right time! Studies show that properties with professional photos earn up to 40% more than those without.

Multi-Channel Distribution Strategy

Online Travel Agencies

- 🏠 Airbnb

- 🌐 VRBO

- 🏨 Booking.com

Direct Booking Channels

- 💻 Property Website

- 📱 Social Media

- 📧 Email Marketing

Local Partnerships

- 🤝 Tourism Boards

- 🏢 Corporate Housing

- 📋 Event Planners

Review Management

- ⭐ Guest Feedback

- 💬 Response Strategy

- 📈 Rating Optimization

Let’s dive into your marketing essentials:

- Platform Optimization:

- Professional photography that tells a story

- Compelling property descriptions

- Strategic keyword placement

- Regular pricing updates

- Brand Development:

- Consistent visual identity

- Unique value proposition for an Airbnb rental arbitrage business.

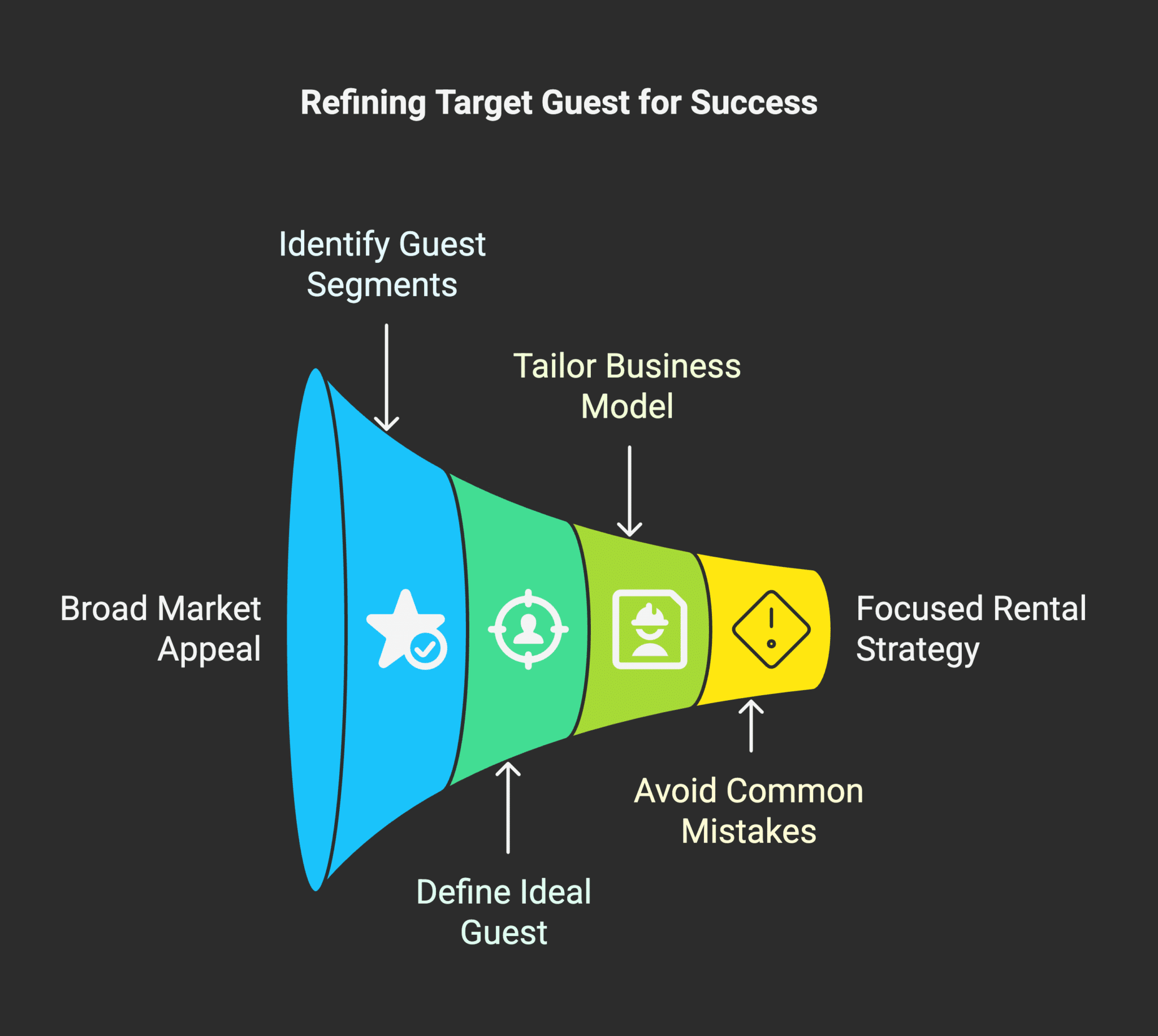

- Target guest persona development

- Local market positioning

- Digital Presence:

- Active social media accounts

- Email newsletter campaigns

- Virtual tours and video content

- Local area guides

Pro Tip: Create a content calendar highlighting your property’s best features during different seasons. Winter photos in summer won’t attract the right guests!

Success Metrics to Track:

- Booking conversion rates

- Average response time

- Guest review scores

- Channel performance

Remember: Your marketing strategy should evolve with your business. What works in high season might need adjustment during slower periods.

Ready to protect your investment? In the next section, let’s explore risk management strategies for Airbnb property owners.

Risk Management and Contingency Planning

Think of risk management as your business’s insurance policy – you hope you’ll never need it, but you’ll be grateful it’s there! In the dynamic world of rental arbitrage, being prepared isn’t just brilliant – it’s essential for survival.

Rental Arbitrage Risk Assessment

High Impact, High Probability

- Regulation Changes

Monitor local laws

- Market Downturns

Maintain emergency fund

High Impact, Low Probability

- Natural Disasters

Comprehensive insurance

- Property Damage

Security deposits & screening

Low Impact, High Probability

- Seasonal Fluctuations

Dynamic pricing strategy

- Maintenance Issues

Preventive maintenance plan

Low Impact, Low Probability

- Supply Chain Delays

Buffer stock management

- Technology Issues

Backup systems in place

Let’s explore your essential risk management strategies:

- Financial Protection:

- Emergency fund (3-6 months of expenses)

- Comprehensive insurance coverage

- Damage deposit policies

- Multiple revenue streams

- Legal Compliance:

- Regular regulation monitoring

- Professional legal counsel

- Updated documentation

- Permit maintenance

- Operational Safeguards to protect your Airbnb rental arbitrage business.:

- Backup service providers

- Guest screening protocols

- Property maintenance schedules

- Emergency response plans

Pro Tip: Review and update your risk management strategy quarterly. Yesterday’s minor concern could be tomorrow’s major challenge!

Key Risk Mitigation Steps:

- Document everything

- Build strong vendor relationships

- Maintain clear communication channels

- Create detailed emergency procedures

Remember: The best risk management strategy is proactive, not reactive. Stay ahead of potential issues by regularly assessing and updating your contingency plans.

Looking to put all these pieces together? Let’s wrap up with our conclusion and action steps.

From Plan to Profit: Your Rental Arbitrage Action Blueprint

Ready to transform this business plan into real-world success? The short-term rental market is projected to hit $335.83 billion by 2032 – and your piece of that pie is waiting!

Your Path to Rental Arbitrage Success

Foundation

- ✓ Market Research

- ✓ Financial Planning

- ✓ Legal Setup

Launch

- ✓ Property Selection

- ✓ System Setup

- ✓ First Booking

Growth

- ✓ Optimization

- ✓ Scaling Systems

- ✓ Team Building

Success

- ✓ Portfolio Growth

- ✓ Brand Recognition

- ✓ Passive Income

Your success roadmap includes:

- Knowledge Foundation:

- Understanding market dynamics

- Mastering financial projections

- Building operational systems

- Creating risk management strategies

- Action Steps:

- Research target markets

- Build financial models

- Develop management systems

- Create marketing plans

- Growth Strategy:

- Monitor performance metrics

- Optimize pricing strategies

- Scale operations

- Expand portfolio

Using Data to Optimize Pricing

Pro Tip: Start small, but think big. Many successful rental arbitrage entrepreneurs began with just one property and grew systematically.

Key Success Factors:

- Continuous market analysis

- Adaptable business strategies

- Strong guest relationships

- Efficient operations

Remember: Your rental arbitrage journey is a marathon, not a sprint. Each step builds the foundation for long-term success in this exciting industry.

Ready to take your first step? Start with thorough market research in your target area – your future success begins with the decisions you make today!

Jermaine Massey

Frequently Asked Questions About Rental Arbitrage

Are you curious about the ins and outs of rental arbitrage? You’re not alone! These are the most common questions entrepreneurs ask when starting their rental arbitrage journey.

From legal considerations to profitability insights, we’ll cover everything you need to know to make informed decisions about your rental arbitrage business.

Q: What is Airbnb rental arbitrage, and how does it work?

A: Airbnb rental arbitrage is a business model where you rent a property long-term and then sublease it on short-term rental platforms like Airbnb or VRBO. It benefits from the difference between your long-term rental costs and the higher rates you can charge for short-term stays. This strategy allows you to start a vacation rental business without owning property, potentially generating significant Airbnb income.

Q: Is rental arbitrage legal?

A: Rental arbitrage legality varies depending on local laws and regulations. While arbitrage is legal in many places, it’s crucial to research your area’s short-term rental regulations and obtain necessary permits. Always inform your landlord and get their permission before starting a rental arbitrage business. Some cities have strict rules about short-term rentals, so staying compliant with local laws is essential.

Q: What are the best cities for Airbnb rental arbitrage in 2025?

A: The best cities for Airbnb rental arbitrage can change based on market conditions, but some popular options include tourist destinations and urban centers with high demand for short-term stays. Look for cities with favorable short-term rental regulations, a steady influx of visitors, and a gap between long-term rental rates and potential short-term rental income. Research local markets thoroughly before deciding where to start your rental arbitrage business.

Q: How can I start a rental arbitrage business?

A: To start a rental arbitrage business, follow these steps:

1) Research local laws and regulations,

2) Secure funding for initial costs,

3) Find a suitable property and negotiate with the landlord,

4) Set up your short-term rental business structure,

5) Furnish and prepare the property,

6) Create attractive listings on platforms like Airbnb or VRBO,

7) Implement a marketing strategy, and

8) Manage guest experiences and property maintenance.

It’s also wise to consider short-term rental insurance to protect your investment.

Q: What are the benefits of rental arbitrage compared to traditional property ownership?

A: Rental arbitrage offers several benefits over traditional property ownership:

1) Lower initial investment, as you don’t need to purchase property.

2) Flexibility to test different markets without long-term commitments,

3) Potential for higher profits compared to long-term rentals,

4) Ability to scale your rental arbitrage business more quickly, and

5) Less responsibility for significant property repairs and maintenance.

However, weighing these benefits against the potential risks and challenges of the short-term rental market is essential.

Q: How profitable is Airbnb rental arbitrage?

A: The profitability of Airbnb rental arbitrage can vary widely depending on factors such as location, property type, and market conditions. A successful Airbnb arbitrage business can generate significant income, often surpassing traditional long-term rental yields. However, it’s essential to account for all business expenses, including rent, utilities, furnishings, cleaning, and platform fees. Properly managing and optimizing your listings can help maximize your profits in the competitive short-term rental market.

Q: What are the main challenges of running a short-term rental arbitrage business?

A: Running a short-term rental arbitrage business comes with several challenges:

1) Navigating the complex and changing local regulations,

2) Managing guest expectations and experiences,

3) Dealing with property maintenance and cleaning between stays,

4) Handling seasonal fluctuations in demand,

5) Competing with other short-term rentals and hotels,

6) Balancing occupancy rates with pricing strategies, and

7) Managing relationships with landlords.

Overcoming these challenges requires dedication, adaptability, and strong business management skills.

Q: How can I scale my rental arbitrage business?

A: To scale your rental arbitrage business, consider these strategies:

1) Expand to multiple properties in different locations,

2) Optimize your listings and pricing to maximize occupancy and revenue.

3) Implement efficient systems for guest communication and property management.

4) Build a team to handle various aspects of the business as it grows.

5) Diversify your marketing efforts to attract a broader range of guests.

6) Consider partnering with property owners or other arbitrage hosts to access more opportunities.

Remember to scale responsibly and ensure each new property meets your profitability criteria. (Ask me how I learned this one.)