Here’s the deal on rental arbitrage startup costs: plan to spend $8,000 to $12,000 for your first property in 2025. This isn’t just a guess – it’s the average from over 1,000 successful hosts who started while juggling full-time jobs.

Rental arbitrage beats traditional real estate. You can start with a used car’s price, not $50,000. Lease a property for $2,000/month, list it short-term, and keep the profit. Hosts earn $1,500-$2,500/month after startup costs.

But here’s what most “gurus” won’t tell you about rental arbitrage startup costs:

- Your first property isn’t your biggest expense – your systems are

- Smart hosts spend 60% of their budget on automation tools

- The right insurance costs more but saves thousands long-term

- Premium furnishings reduce replacement costs by 40%

Want real numbers? Meet Sarah, a nurse who launched her first rental arbitrage property with $10,000:

- Security deposit and first month’s rent: $4,000

- Furnishings and setup: $3,500

- Systems and automation: $1,500

- Legal and insurance: $1,000

Three months later, her property brings in $2,800 every month. This requires just 2 hours of management each week. Maria, a retired teacher, followed the same startup cost plan but focused on extended stays. This choice cut her ongoing expenses by 30%.

This guide details every rental arbitrage startup cost you’ll encounter in 2025. You’ll find exact numbers, hidden fees, and tools that genuinely save you money. No fluff, no theory—just real costs from hosts who’ve built profitable properties while working full-time.

Want to master rental arbitrage startup costs? Let’s start with the three key numbers for your first property.

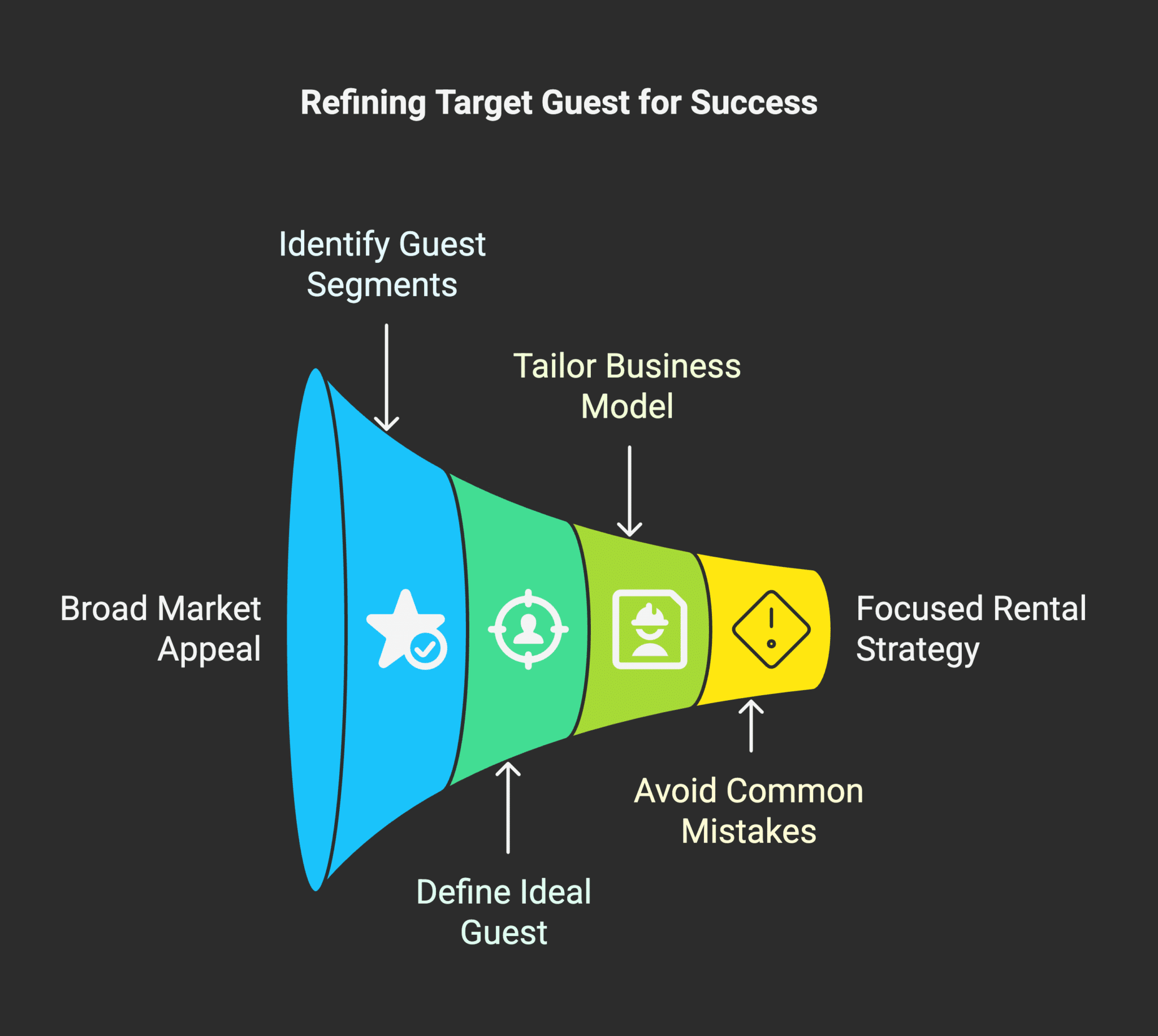

Understanding Rental Arbitrage Business Models

To succeed in rental arbitrage, know its core mechanics. Then, align them with your goals. For Sarah, who juggles nursing shifts while growing her business, or Maria, who seeks to create a legacy, grasping these basics is vital.

Rental arbitrage has three main components: revenue generation, strategic partnerships, and scalable operations. Let’s break down each part to see how they work together for a sustainable business model.

Revenue Streams

The main idea is simple: lease properties at market rates. Then, sublease them for a profit using short-term rentals. For instance, if you lease a property for $2,000 a month and earn $3,500 from short-term rentals after expenses, you’ll have a $1,500 monthly revenue stream. Additional revenue opportunities include:

- Cleaning fees ($75-150 per turnover)

- Late check-out fees ($25-50 per instance)

- Experience packages ($50-200 per stay)

- Extended stay discounts that increase overall occupancy

For Sarah, this could mean making her monthly nursing salary from just 2-3 well-managed properties. For Maria, it represents steady retirement income that can grow over time.

Key Partnerships

Success in rental arbitrage depends heavily on building strong relationships with:

Property Owners:

- Establish trust through transparent communication

- Show professional property management

- Share maintenance updates and improvements

- Build long-term relationships for future properties

Service Providers:

- Reliable cleaning teams ($25-35/hour)

- On-call maintenance personnel

- Professional photographers ($200-300 per property)

- Local experience providers for guest packages

Platform Partners:

- Airbnb (3% standard host fee)

- VRBO (5% commission structure)

- Booking.com (15% commission but wider reach)

- Property management software providers

These partnerships are valuable for busy professionals. For example, Sarah can count on trusted teams during her nursing shifts. Maria also benefits as she seeks to simplify hands-on management.

Scalability Strategy

The beauty of rental arbitrage lies in its flexible scaling options:

Vertical Growth:

- Optimize existing properties

- Increase nightly rates through better reviews

- Add premium amenities for higher margins

- Implement automated systems for efficiency

Horizontal Growth:

- Add new properties strategically

- Expand to different neighborhoods or cities

- Diversify property types (luxury, family, business)

- Build a portfolio that matches your goals

For Sarah and Maria, starting with one well-managed property allows for steady growth. They can manage guest messages during breaks. They can also coordinate cleaning services from afar. This lets them grow their business at a pace that feels right.

Key Operational Components:

- Property selection and lease negotiations

- Platform management and pricing strategy

- Guest communications and experience design

- Maintenance and cleaning coordination

- Financial tracking and optimization

- Marketing and brand development

Why Rental Arbitrage Appeals to Working Women

Rental arbitrage is gaining traction among working women. They want to diversify their income and reach financial independence.

This method allows entrepreneurs to lease properties and then sublease them as vacation rentals. It creates a profitable business with minimal upfront investment.

Rental arbitrage has unique benefits for women balancing careers and entrepreneurial goals:

Low Barrier to Entry

Traditional real estate often requires over $50,000 for a down payment. In contrast, rental arbitrage needs much less:

- Initial security deposit ($2,000-4,000)

- First month’s rent ($2,000-3,000)

- Basic furnishings ($5,000-8,000)

- Legal setup ($1,000-2,000)

This lower cost helps professionals like Sarah use savings instead of large loans.

Passive Income Potential

Once established, the business can operate mostly on its own:

- Automated booking systems

- Remote access solutions

- Professional cleaning teams

- Digital check-in processes

- Virtual guest communication

For Maria, this means creating income streams that don’t need her constant attention, aiding her retirement goals.

Schedule Flexibility

This model works well with non-traditional work hours:

- Manage guest messages during breaks

- Schedule maintenance around availability

- Automate routine tasks

- Delegate time-sensitive activities

- Build systems around your lifestyle

This flexibility helps Sarah manage properties between nursing shifts or during other off hours.

Scalable Growth Path

Start small and grow as you gain skills and confidence:

- Begin with one property

- Test and refine your systems

- Add properties strategically

- Increase efficiency through automation

- Build a support team gradually

Expanding Businesses with Rental Arbitrage

Sarah and Maria can expand their businesses at a pace that suits them. A key reason rental arbitrage attracts working women is its low risk. By leasing instead of buying, they can explore the short-term rental market without long-term commitments. This lets women grow their businesses while maintaining their careers.

Opportunities in Short-Term Rentals

As demand for short-term rentals rises, many working women find success as property managers in hospitality.

Managing rental properties remotely allows them to fit this business into busy schedules.

Benefits of Property Management Software

With all-in-one property management software, they can:

- Streamline operations

- Manage their portfolios from anywhere

- Save time and effort

Scaling Operations with Technology

As their businesses grow, many women scale operations using technology and automation. These platforms help property managers:

- Boost rental income

- Enhance strategies

- Maintain quality and a personal touch

Rental arbitrage attracts working women because it allows them to create a successful business. This can happen while they balance their career goals and personal life.

Breaking Down Initial Investment Requirements

Startup costs for rental arbitrage can be divided into several categories. Let’s explore each to help you plan your budget effectively. Note: We recommend budgeting about $25 per square foot for total setup costs. The following figures are estimates and may vary by location and property type.

Essential Startup Costs

- Security Deposits and First Month’s Rent

- Typically, 1-2 months’ rent as the security deposit

- First month’s rent upfront

- Example: For a $2,000/month property, budget $4,000-$6,000

- Pro Tip: Negotiate payment terms with property owners for a more manageable cash flow

- Furnishing and Setup

- Basic furniture package: $5,000-$8,000

- Linens and supplies: $1,000-$1,500

- Electronics and appliances: $1,500-$2,500

- Design consultation: $500-$1,000 (optional but recommended)

- Remember: Quality furnishings reduce replacement costs long-term

- Legal and Administrative

- Business registration: $500-$1,000

- Insurance policies: $1,000-$2,000 annually

- Accounting software: $200-$500 annually

- Legal consultation: $300-$800 (recommended for contract review)

Operational Systems Setup

- Property Management Software

- Channel managers: $30-$100/month

- Pricing tools: $20-$50/month

- Communication systems: $20-$40/month

- Guest screening tools: $15-$30/month

- Automation platforms: $25-$75/month

Legal and Contractual Requirements

Before diving into rental arbitrage, understanding the legal framework is crucial. For Maria, who values compliance and stability, having these elements in order provides peace of mind. For Sarah, working and building her business, good documentation keeps things running smoothly. This matters, especially during her busy hospital shifts.

Essential Legal Components:

- Lease Agreements

- Explicit subletting permissions

- Terms for property modifications

- Maintenance responsibilities

- Renewal options and terms

- Property owner communication protocols

- Regulatory Compliance

- Short-term rental licenses ($200-500 annually)

- Local business permits

- Health and safety certifications

- Occupancy restrictions

- Noise ordinance compliance

- Insurance Coverage

- General liability ($1,000-2,000/year)

- Property damage protection

- Business interruption coverage

- Guest injury protection

- Professional liability insurance

- Tax Considerations

- Local occupancy taxes (5-15%)

- Income tax reporting requirements

- Deduction documentation

- Quarterly estimated payments

- Business expense tracking

Pro Tip: Successful hosts often make a compliance checklist. They also set calendar reminders for renewal dates. This helps them keep proper documentation while managing other tasks.

Marketing and Lead Generation

- Platform Presence

- Airbnb host fees: 3-5% per booking

- VRBO annual subscription: $499 or 8% per booking

- Payment processing fees: 2.9% + $0.30 per transaction

- Premium listing features: $100-200/month (optional)

- Visual Content Creation

- Professional photography: $300-$1,000 per property

- Virtual tour development: $200-$500

- Video content: $500-$1,500 (optional)

- Seasonal photo updates: $200-$400 annually

- Digital Marketing

- Local SEO optimization: $500-$1,500/month

- Social media management: $200-$800/month

- Content creation: $300-$1,000/month

- Email marketing software: $30-$100/month

Money-Saving Tips:

- Use Canva Pro ($12.99/month) for DIY listing design and social media content

- Join property management groups for bulk purchase discounts

- Consider staging services for initial photos, then purchase similar items

- Leverage free social media platforms for organic reach

- Start with essential tools and add premium features as revenue grows

For Sarah’s Schedule:

- Focus on automation tools to manage guest communication during nursing shifts

- Invest in quality photos upfront to reduce ongoing marketing needs

- Use scheduling tools to maintain social media presence efficiently

For Maria’s Approach:

- Prioritize professional services to trim hands-on management

- Invest in comprehensive property management systems

- Focus on long-term guest relationships to reduce marketing costs

Remember: While these costs may seem substantial, they represent an investment in your business’s foundation. Starting with proper systems and marketing strategies typically leads to higher occupancy rates and better reviews, ultimately increasing your return on investment.

Hidden Costs in Rental Arbitrage Ventures

Understanding hidden costs helps prevent unexpected financial strain and ensures sustainable business growth. For Sarah, managing these unexpected expenses alongside her nursing career requires strategic planning. For Maria, who values stability in retirement, anticipating these costs helps maintain consistent cash flow.

Unexpected Operational Expenses

The true cost of property management extends far beyond basic lease payments and furnishings. Successful hosts build robust financial buffers for various contingencies:

- Maintenance and Repairs

- Emergency repairs fund: $1,000-$2,000 per property

- Regular maintenance: $200-$400/month

- Replacement costs for damaged items: 15-20% of furnishing costs annually

- Deep cleaning sessions: $250-$400 quarterly

- Preventive maintenance: $500-$1,000 annually

Pro Tip: Create a dedicated emergency fund covering 3 months of expenses before scaling to additional properties.

- Utility Fluctuations

- Seasonal variations: 20-30% increase during peak seasons

- Usage spikes during full occupancy: 40-50% above baseline

- Buffer for rate increases: 10-15% annually

- Smart home technology: $300-$500 for monitoring

- Energy efficiency upgrades: $1,000-$2,000 initial investment

Strategy: Install smart thermostats and monitoring systems to control utility costs remotely.

Market-Related Expenses

Market conditions can significantly impact your bottom line through various hidden costs:

- Platform Fees

- Commission rates: 3-5% per booking

- Payment processing fees: 2.9% + $0.30 per transaction

- Premium listing features: $100-200/month

- Channel manager fees: $30-100/month per platform

- Currency conversion fees: 1-3% for international guests

- Seasonal Adjustments

- Off-season revenue gaps: Plan for 30-40% revenue reduction

- Peak season additional services: $200-400/month

- Marketing costs during slow periods: $300-500/month

- Seasonal inventory updates: $200-300/quarter

- Dynamic pricing tool subscriptions: $30-50/month

- Guest Experience Costs

- Welcome packages: $15-25 per stay

- Amenity restocking: $100-200/month

- Special request accommodations: $50-100/month

- Guest communication tools: $20-40/month

- Review management systems: $30-50/month

- Professional Services

- Accounting services: $200-400/month

- Legal consultations: $300-500/quarter

- Tax preparation: $500-1,000 annually

- Business insurance adjustments: $200-300/year

- Professional cleaning between stays: $100-150 per turnover

For Sarah’s Situation:

- Prioritize automation tools to manage maintenance requests during shifts

- Build relationships with reliable 24/7 maintenance providers

- Set up automatic utility monitoring systems

For Maria’s Approach:

- Focus on preventive maintenance to reduce emergency costs

- Invest in quality furnishings to minimize replacement needs

- Create seasonal marketing strategies in advance

Strategic Conclusions: Maximizing Success Through Quality and Extended Stays

The path to sustainable success in rental arbitrage often challenges traditional startup strategies. Many focus on cutting initial costs and boosting short-term returns. However, our experience shows that offering premium quality and targeting extended stays leads to a more sustainable and profitable business model.

The Premium Quality Advantage

Investing more at the start of your rental arbitrage business can lead to greater long-term success. It can also reduce ongoing challenges. For Sarah, balancing nursing and property management is key. High-quality furnishings and solid systems mean fewer emergency calls and less maintenance trouble. For Maria, who seeks stability in retirement, premium properties attract reliable guests and command higher rates.

Consider these essential premium investments:

- Premium property locations: Focus on areas with strong extended-stay demand

- Commercial-grade furnishings: Invest in durability over initial cost savings

- Professional automation systems: Reduce daily management requirements

- Comprehensive insurance coverage: Protect against unforeseen issues

- Professional marketing assets: Stand out in competitive markets

Extended Stay Strategy

Combining this premium approach with an extended-stay focus creates a powerful business model that particularly benefits busy professionals and those seeking stable income streams. Data shows that properties focusing on stays of 7+ days experience:

- 40% reduction in turnover costs

- 60% decrease in daily management time

- 25% lower annual maintenance expenses

- 30% more predictable monthly income

- Significantly reduced regulatory compliance burden

For Sarah, this means fewer turnovers to manage between nursing shifts and more predictable income. For Maria, it provides the stability and peace of mind crucial for retirement planning. The extended-stay model helps build stronger relationships with guests. This leads to more repeat bookings and better reviews.

Implementation Tips:

- Design spaces that cater to longer stays (full kitchens, workspaces, storage)

- Create weekly and monthly rate structures that incentivize longer bookings

- Build relationships with local businesses and medical facilities for corporate stays

- Develop amenity packages specific to extended-stay guests

- Focus marketing efforts on platforms that cater to longer-term travelers

This approach combines premium quality with longer stays. It may need more upfront money, but it leads to a sustainable and profitable business model. This model fits well with the needs of busy professionals and those looking for steady retirement income.

Jermaine Massey